Louisiana Tuition Donation Rebate program

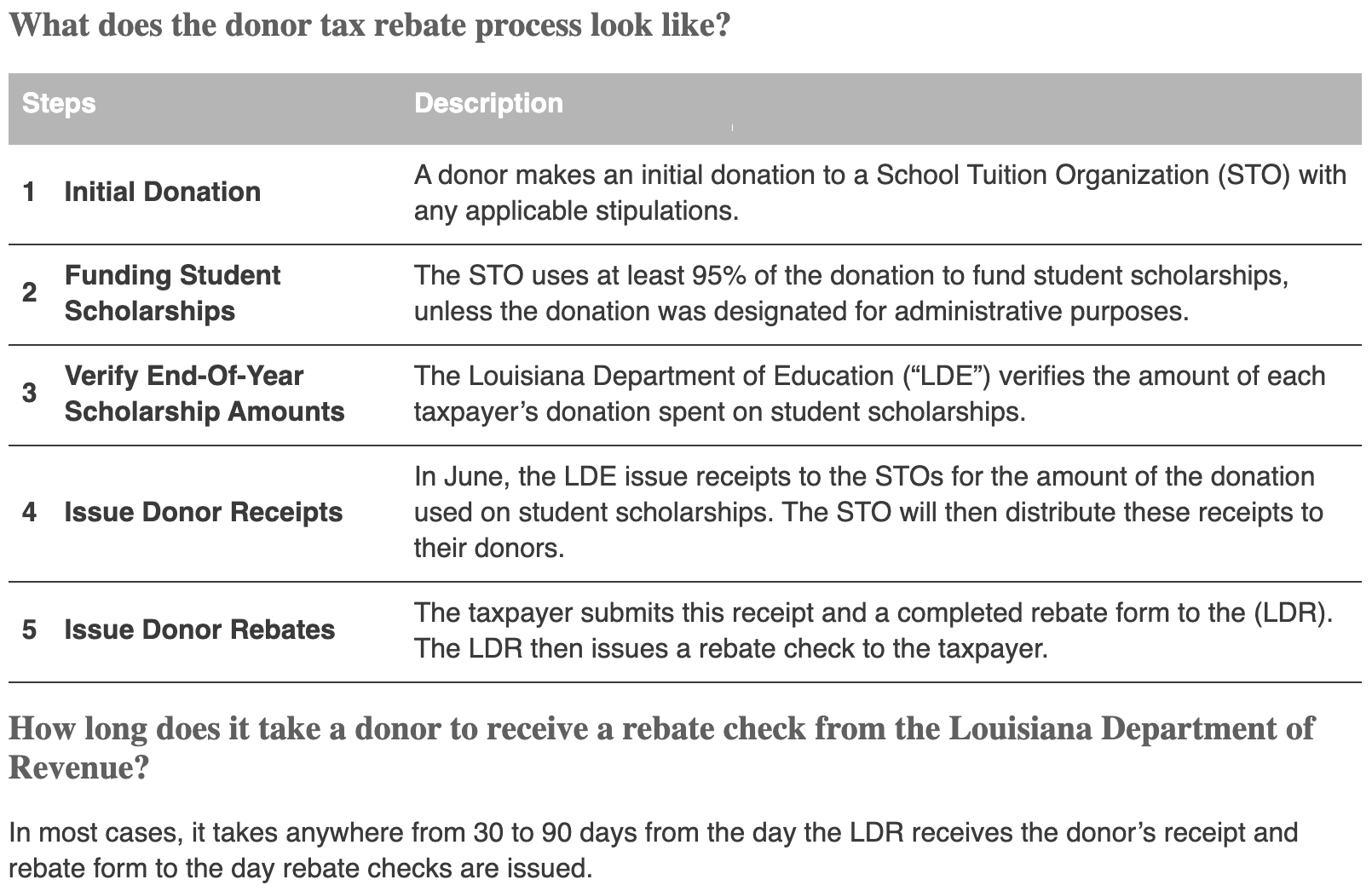

- The TDR program benefits taxpayers because they receive a rebate for the portion of their donation that a School Tuition Organization uses to fund student scholarships at the end of each school year, 95% of the donation. (Rebates do not include the portion of each donation spent on administrative costs, up to 5% may be used)

- Donors may choose to designate more, up to 100% of their donation for administrative costs instead of student scholarships; this donation will be eligible for a Federal tax deduction, but not a rebate.

- The donor does not have to be a resident of Louisiana. However, they will need to file a LA income tax return to qualify for the rebate, which may be a $0 income return if they do not owe LA income taxes.

- This is a rebate, not a tax credit and is not claimed on a tax return. The rebate is claimed on a separate claim form and is issued in the form of a check.

For more information, please see the links below.

Donors with specific questions regarding how their donation and potential rebate impacts their tax liability should consult a tax lawyer or advisor, as each donor’s circumstances may vary.